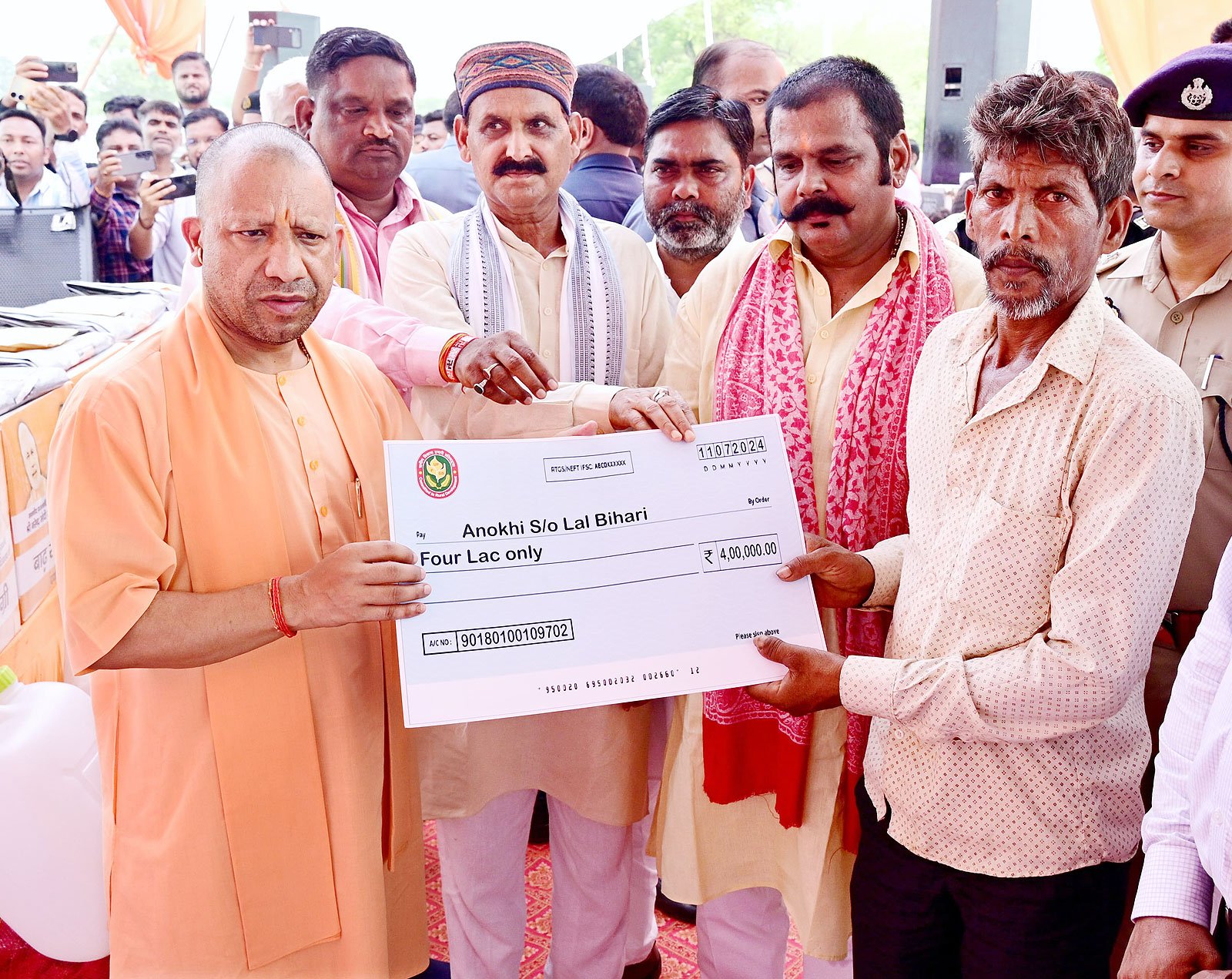

Lucknow : In a high-level meeting, Chief Minister Yogi Adityanath reviewed the latest status of non-tax revenue receipts for the current financial year. During the meeting, Finance Minister Suresh Khanna and Transport Minister Dayashankar Singh and Stamp and Registration Minister Ravindra Jaiswal were also present.

● The Chief Minister reviewed the revenue receipts compared to the collection targets in various departments, including GST, VAT, Excise, Stamp and Registration, Transport, Land Revenue, and Energy. He provided necessary guidelines to the departmental officers.

Key guidelines given by the Chief Minister in the meeting-

– Owing to planned efforts, there has been a

-More than Rs 51K crore revenue collected in Uttar Pradesh in the first quarter

-Identify new sources to boost revenue, adopt technology, implement reforms: Chief Minister

-Chief Minister reviews the non-tax revenue receipts of the first quarter of the current financial year, directs acceleration of efforts to achieve targets

-CM expresses satisfaction over increase in revenue collection in every sector including mining, stamp and registration, excise & transport

-Set targets for special disciplinary units of the State Tax Department, send performance report to CM Office every month: Chief Minister

-Chief Minister reviews updated status of non-tax revenue receipts in the current financial year continuous increase in the state’s tax and non-tax revenue collection. In the first quarter of the current financial year, over Rs 51,000 crore has been received through various means. Of this, approximately Rs 28,000 crore came from GST/VAT, Rs 12,000 crore from excise tax, Rs 7,500 crore from stamp and registration, Rs 3000 crore from transport, Rs 733 crore from energy, and over Rs 114 crore from land revenue. This situation is considered satisfactory. The collected amount will be utilized for the state’s development, public interest, and welfare projects.

– The state holds immense possibilities. Due to continuous efforts, there are now more than 31 lakh GST-registered traders. This number should be increased further. We should also explore new sources to boost revenue collection by simplifying rules, adopting technology, and implementing reforms.

– Revenue theft is a national loss. Increased vigilance is necessary to prevent GST theft and evasion. The activity of the State Tax Department’s special disciplinary units and mobile squad units should be intensified. Although their recent alertness has effectively curbed tax theft and evasion, there is still a need for significant improvements in their working methods. Targets should be set for these units, and their performance reports should be submitted to the Chief Minister’s office monthly.

– We have successfully curbed the production and sale of illicit liquor. Continued action is necessary to maintain this progress. We must remain vigilant to prevent illicit liquor from other states from entering ours. The Excise Department is expected to make stronger efforts to meet the revenue collection targets.

– Problems between builders and buyers in Noida and Greater Noida should be resolved swiftly. It is essential to protect the interests of every buyer and ensure that they receive the registry of their flats on time. Every necessary step must be taken to achieve this.

– No vehicle should be on the road without a permit or fitness certificate. Conduct intensive checks to ensure compliance, but ensure that these checks do not obstruct traffic. RTO offices should be freed from middlemen, as they hinder the system’s efficiency.