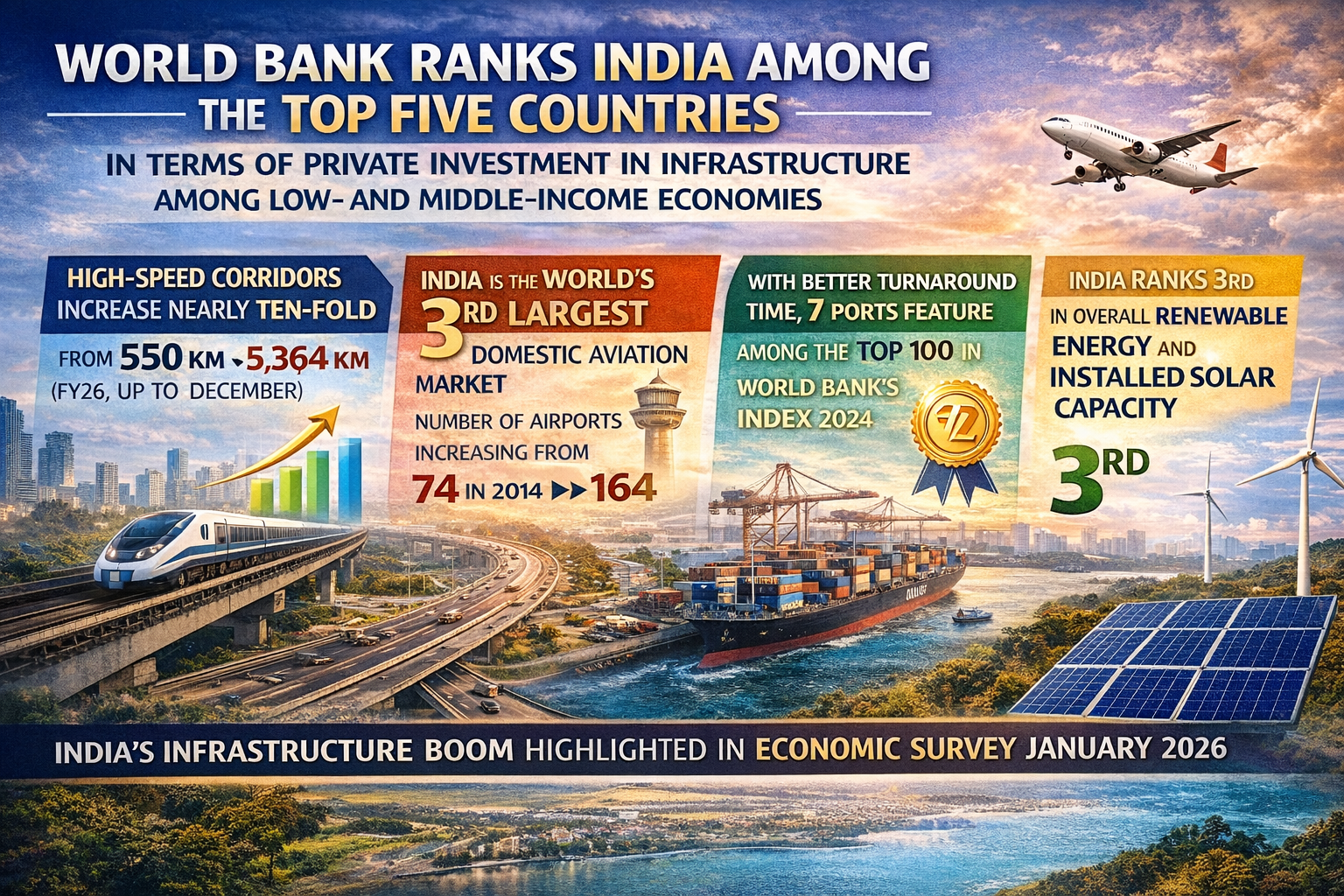

New Delhi — India has emerged as one of the world’s top five countries for private investment in infrastructure among low- and middle-income economies, according to the World Bank, reaffirming the country’s growing global stature in infrastructure development. This was highlighted in the Economic Survey 2025–26 tabled in Parliament on Thursday by Union Finance and Corporate Affairs Minister Nirmala Sitharaman.

The Survey underscores that infrastructure remains central to India’s growth strategy, supported by a sustained rise in public capital expenditure since FY15 and the institutionalisation of integrated, multimodal planning through PM GatiShakti. Complemented by the National Logistics Policy and digital platforms, these reforms have helped reduce transaction costs, execution risks, and project delays.

Public Capex Drives Growth

Public capital expenditure has risen nearly 4.2 times over the past eight years—from ₹2.63 lakh crore in FY18 to ₹11.21 lakh crore in FY26 (Budget Estimates). Effective capital expenditure in FY26 is estimated at ₹15.48 lakh crore, positioning infrastructure as a key growth driver due to its strong multiplier effects on the economy.

Evolving Infrastructure Financing

India’s infrastructure financing landscape is also undergoing a transformation, with increasing diversification beyond traditional bank credit. Credit from non-banking financial companies (NBFCs) to the commercial sector grew at a CAGR of 43.3 per cent during FY20–FY25. Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs) are playing a growing role in mobilising long-term institutional capital.

Strong Public-Private Partnership Momentum

The Survey notes that India is the largest recipient of private participation in infrastructure (PPI) investment in South Asia, accounting for over 90 per cent of the region’s total. The strong global ranking is reflected domestically in a sharp rise in project approvals by the Public-Private Partnership Appraisal Committee (PPPAC).

Rapid Expansion of Core Infrastructure

India’s physical infrastructure has expanded significantly across sectors:

-

National Highways: The NH network grew by about 60 per cent from 91,287 km in FY14 to 1,46,572 km in FY26 (up to December). Operational high-speed corridors increased nearly ten-fold, from 550 km to 5,364 km during the same period.

-

Railways: The rail network reached 69,439 route km by March 2025, with 99.1 per cent electrification achieved by October 2025. Record capital expenditure has focused on new lines, dedicated freight corridors, high-speed rail, station redevelopment, and safety upgrades like the Kavach system.

-

Civil Aviation: India is now the world’s third-largest domestic aviation market. The number of airports increased from 74 in 2014 to 164 in 2025. Passenger traffic stood at 412 million in FY25 and is projected to reach 665 million by FY31.

-

Ports and Shipping: Seven Indian ports feature among the top 100 in the World Bank’s Container Port Performance Index 2024, reflecting near-global standards in turnaround time. Cargo movement through inland waterways rose sharply from 18 MMT in 2013–14 to 146 MMT in 2024–25.

Energy Sector Transformation

India ranks third globally in overall renewable energy capacity and installed solar capacity. Renewable energy now accounts for nearly 50 per cent of total power generation capacity, with total RE capacity rising more than threefold over the past decade. Power sector reforms have also led to improved financial health of DISCOMs, which recorded profits for the first time in FY25.

Outlook

The Economic Survey concludes that India’s infrastructure strategy reflects a decisive shift towards scale, integration, and quality. Sustained public investment, integrated planning through PM GatiShakti, and reforms in financing and public–private partnerships have begun to yield tangible efficiency gains—supporting faster growth, improved logistics performance, and enhanced global competitiveness.