Mumbai — In a major monetary policy move, the Reserve Bank of India (RBI) today cut the repo rate by 50 basis points, lowering it from 6.0% to 5.5%, sparking a wave of optimism across the Indian financial markets. The surprise rate cut was accompanied by a 100 basis point reduction in the Cash Reserve Ratio (CRR), now down to 3% from 4%, aimed at injecting greater liquidity into the system.

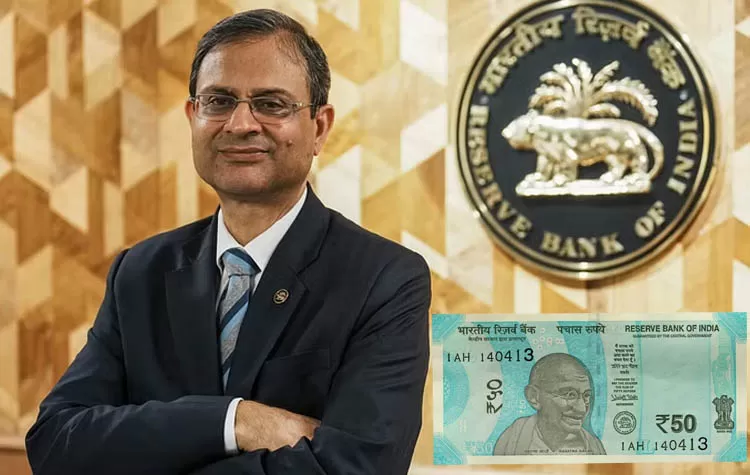

The announcement, made by RBI Governor Sanjay Malhotra, was instantly welcomed by the stock markets, with both the Sensex and Nifty registering sharp gains as investor confidence surged.

Markets React: Sensex and Nifty Hit Fresh Highs

Shortly after the announcement, at around 10:46 AM, the BSE Sensex was up by 505.7 points (0.62%), trading at 81,947.74, while the Nifty50 gained 168.40 points (0.68%) to hit 24,919.30.

The Nifty Bank index also saw a solid jump of 682.95 points (1.22%), reaching 56,443.80. Meanwhile, the Nifty Midcap 100 climbed 363.20 points (0.62%) to 58,666.20, and the Nifty Smallcap 100 was up by 48.25 points (0.26%), trading at 18,480.85.

Leading the rally were heavyweight stocks such as Bajaj Finance, Axis Bank, Maruti Suzuki, Kotak Mahindra Bank, and IndusInd Bank. On the flip side, select counters like Sun Pharma, Infosys, Nestle India, and HCL Tech posted marginal declines.

Expert Views: Push for Credit Growth and Stability

According to Dr. V.K. Vijay Kumar, Chief Investment Strategist at Niyojit Investments Ltd., “This move signals the RBI’s intent to boost credit growth, especially in the face of declining margins. The shift in monetary stance from accommodative to neutral indicates that further rate cuts may only follow if absolutely necessary.”

Madhavi Arora, Chief Economist at MK Global, noted that “RBI seems to have frontloaded all possible policy tools — an aggressive rate cut and CRR reduction — to ensure systemic liquidity. The onus now shifts to banks to transmit the benefits and stimulate easier financial conditions.”

Market Sentiment and Institutional Activity

Before the RBI announcement, domestic benchmark indices opened flat, though buying activity was already evident in IT and PSU banking stocks — a sign that the markets were pricing in a dovish turn from the central bank.

Volatility dipped sharply, with the India VIX falling 4.21% to 15.08, signaling a more stable trading environment in the short term.

On the institutional front, Foreign Institutional Investors (FIIs) were net sellers on June 5, offloading shares worth ₹208.47 crore. In contrast, Domestic Institutional Investors (DIIs) stepped in with heavy buying, recording a net purchase of ₹2,382.40 crore, providing substantial support to the indices.

A Step Toward Economic Acceleration

The RBI’s decision is widely seen as a bold effort to stimulate economic growth by lowering borrowing costs and boosting liquidity, especially at a time when the Indian economy is navigating global uncertainties and internal consumption pressures.

As banks recalibrate their lending rates in response, the real test will be the pace and effectiveness of transmission — something both markets and policymakers will watch closely in the weeks ahead.

For now, the RBI’s dual-move of a repo rate cut and CRR reduction has injected much-needed cheer into the Indian financial ecosystem, reinforcing optimism for sustained economic momentum.