Lucknow: The year 2025 will be remembered as a defining moment in modern global defence history—a year when geopolitics hardened, military budgets shattered records, technology reshaped battlefields, and long-simmering conflicts pushed the world closer to a permanent state of strategic tension. From Eastern Europe to the Middle East and the Indo-Pacific, nations recalibrated their security priorities in response to a volatile international order where deterrence, rather than diplomacy, increasingly dictated policy.

Global military spending surged to an unprecedented $2.7 trillion, reflecting not only ongoing wars in Ukraine and Gaza but also the deepening anxieties around China’s rise, Russia’s sustained war economy, and the fragility of existing alliances. Defence became less about preparation for hypothetical wars and more about managing real, active conflicts and emerging technologies that are redefining warfare itself.

As governments poured resources into hypersonics, artificial intelligence, autonomous platforms, and next-generation aircraft, the defence industry experienced one of its most transformative—and lucrative—years. Yet beneath the headline numbers lay uncomfortable questions about sustainability, ethics, and the long-term consequences of a world increasingly armed for confrontation.

Record Defence Spending: Security Comes at a Cost

According to the Stockholm International Peace Research Institute (SIPRI), 2025 marked the steepest year-on-year rise in global military expenditure in decades—over 9% higher than 2024. This surge reflected a convergence of pressures: prolonged wars, fractured diplomacy, and a widespread belief that the post-Cold War security architecture has fundamentally eroded.

The United States remained the undisputed leader, with defence spending nearing $1 trillion, driven by commitments to Ukraine, Israel, Indo-Pacific deterrence, and a massive push into next-generation capabilities. China, spending an estimated $314 billion, continued its steady military expansion, particularly in naval power, space systems, and AI-driven command structures.

Europe witnessed some of the most dramatic increases. At the NATO Hague Summit in June, alliance members agreed—controversially—to aim for defence spending of up to 5% of GDP, a significant leap from the long-standing 2% benchmark. The move was widely interpreted as a direct response to Russia’s continued aggression in Ukraine and fears of future escalation.

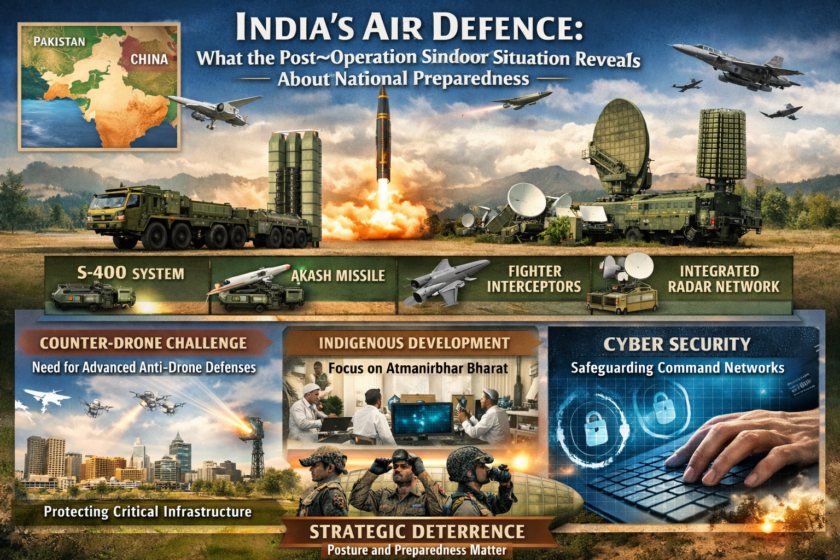

Despite Western sanctions, Russia maintained estimated defence spending between $126–147 billion, sustaining a war-driven economy heavily oriented toward artillery, missiles, and manpower. India, facing unresolved border tensions with China and a volatile regional environment, increased its defence budget to around $86 billion, prioritising modernisation and indigenous production. In the Middle East, Saudi Arabia invested approximately $75 billion, largely focused on air defence and missile interception amid regional instability.

While defence industries thrived, economists warned that ballooning military budgets strained public finances and diverted resources from health, education, and climate resilience—highlighting the growing trade-off between security and sustainable development.

Wars That Refused to End

If defence spending told one side of the story, the battlefields told another.

The Russia–Ukraine war, now in its fourth year, remained Europe’s bloodiest conflict since World War II. Russian forces managed to capture between 4,700 and 6,000 square kilometres in eastern Ukraine during 2025, including strategic areas near Pokrovsk in Donetsk. Yet these gains came at staggering human cost. Estimates suggest over 500,000 Russian casualties since 2022, with Ukraine also suffering immense losses.

Despite advanced drones, Western weapons, and tactical innovations, the war settled into a brutal war of attrition. U.S.-led diplomatic efforts late in the year attempted to broker a ceasefire, but Moscow’s maximalist demands—particularly on territory and NATO expansion—derailed meaningful progress.

In the Middle East, the Israel–Hamas war dominated global headlines. By the end of 2025, reported casualties exceeded 70,000 Palestinians and over 2,000 Israelis, making it one of the deadliest conflicts in the region’s recent history. Multiple ceasefires collapsed before a U.S.-brokered truce in October partially stabilised the situation, though violations continued.

The conflict rapidly expanded beyond Gaza. Israel conducted strikes across Iran, Lebanon, Syria, Yemen, and even Qatar, triggering direct exchanges with Iran and sustained clashes with Hezbollah. Meanwhile, Houthi attacks disrupted Red Sea shipping, underscoring how regional wars now ripple through global trade and security.

Elsewhere, Sudan’s civil war became the world’s worst humanitarian crisis, with over 150,000 deaths and millions displaced. Prolonged violence in Myanmar, alongside emerging India–Pakistan skirmishes, reinforced a grim statistic: the number of active global conflicts has nearly doubled over the past five years.

Technology Redefines the Battlefield

Amid these wars, 2025 emerged as a landmark year for military innovation.

The U.S. Air Force awarded Boeing the coveted Next-Generation Air Dominance (NGAD) contract for its F-47 fighter, marking a major comeback for the aerospace giant. Designed to operate alongside autonomous drone “wingmen,” the aircraft symbolises the future of manned-unmanned combat integration.

Autonomy took centre stage. Collaborative Combat Aircraft (CCA) developed by General Atomics and Anduril successfully completed flight tests, bringing AI-driven decision-making closer to operational reality. Hypersonic development accelerated through programmes such as Kratos’ MACH-TB, while multiple nations tested weapons capable of travelling at over five times the speed of sound.

One of the most consequential breakthroughs came from Israel, where the Iron Beam laser defence system became operational. Capable of neutralising rockets and drones at a fraction of traditional missile costs, the system signalled a shift toward directed-energy weapons that could transform air defence economics.

Unmanned underwater vehicles (UUVs), cyber warfare platforms, quantum sensing, and space-based surveillance expanded rapidly, particularly under AUKUS Pillar II, which focuses on advanced technologies beyond submarines. Meanwhile, additive manufacturing and counter-drone systems became central themes at global defence expos.

Alliances Harden, Rivalries Deepen

Strategic alliances evolved rapidly in 2025.

NATO’s Hague Summit reaffirmed collective defence commitments and accelerated stockpile replenishment, particularly for artillery, air defence, and ammunition. Newly appointed Secretary General Mark Rutte emphasised readiness and deterrence, citing frequent airspace interceptions near alliance borders.

AUKUS advanced significantly with the signing of the Geelong Treaty, deepening submarine cooperation between Australia, the UK, and the US. Australia committed billions toward industrial capacity, while discussions began on expanding Pillar II collaboration to include Japan and South Korea.

Meanwhile, U.S.–China tensions intensified. Pentagon assessments highlighted Beijing’s rapid progress in AI-enabled warfare and its December military drills encircling Taiwan. Although defence dialogues between Washington and Beijing resumed, China’s restrictions on rare-earth exports exposed vulnerabilities in global defence supply chains.

Industry Booms, Challenges Persist

For defence manufacturers, 2025 was a year of both opportunity and strain. Lockheed Martin continued to dominate with F-35 exports and missile contracts, while Boeing secured major wins in fighters, rotorcraft, and sustainment programmes. European firms ramped up production of artillery systems and trainers to meet NATO demand.

Yet challenges remained. Workforce shortages, cost overruns, ethical concerns over AI weapons, and political uncertainty—particularly in the US—created turbulence. Russia’s defence output showed signs of slowing as recruitment declined, even as its war demands persisted.

Looking Ahead to 2026

As 2025 closed, the world stood at a crossroads. China’s Taiwan drills, fragile Middle East ceasefires, and unresolved wars underscored a harsh reality: deterrence has replaced optimism as the dominant global security doctrine.

While rising defence budgets promise technological breakthroughs, they also carry the risk of escalation. Diplomatic initiatives offer cautious hope, but lasting peace remains elusive in a world increasingly defined by armed readiness.

In many ways, 2025 redefined global defence—a year where record investments met relentless conflict, and innovation raced ahead of diplomacy. The defence sector proved resilient and adaptive, yet the broader question lingers: can technological superiority and military spending deliver lasting security, or will they merely prolong instability?

As nations march into 2026 more heavily armed than ever, the challenge will be not just winning wars—but preventing the next ones from becoming inevitable.